shoes-chersa.ru

Tools

Copper Trade Symbol

![]()

Exchange Symbol, HG ; Contract, High Grade Copper ; Exchange, COMEX ; Tick Size, $ per pound ($ per contract) ; Margin/Maintenance, $6,/5, The symbol for copper futures CFDs in MT4 is shoes-chersa.ru What copper CFDs can I trade? Axi offers shoes-chersa.ru CFDs. View live CFDs on Copper chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Copper futures contracts trade on exchanges around the world, including the London Metal Exchange (LME) and the Commodity Exchange (COMEX) under the Chicago. The copper market is open from to GMT. What Affects the Copper Price. Like most commodities, copper price changes based supply and demand. Copper is. Why Trade Copper futures? Copper futures (contract symbol = HG) offer traders an opportunity to diversify their trading portfolio as copper is generally. Considering trading copper futures? Here are the copper futures contract specifications. Exchange, Product Name, Symbol, COMEX, Copper, /HG. Copper. Copper, chemical symbol Cu, is a shiny, red-orange metal that has a The most important trading venues for copper are the London Metal Exchange. Copper Futures - Dec 24 (HGZ4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %. Exchange Symbol, HG ; Contract, High Grade Copper ; Exchange, COMEX ; Tick Size, $ per pound ($ per contract) ; Margin/Maintenance, $6,/5, The symbol for copper futures CFDs in MT4 is shoes-chersa.ru What copper CFDs can I trade? Axi offers shoes-chersa.ru CFDs. View live CFDs on Copper chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Copper futures contracts trade on exchanges around the world, including the London Metal Exchange (LME) and the Commodity Exchange (COMEX) under the Chicago. The copper market is open from to GMT. What Affects the Copper Price. Like most commodities, copper price changes based supply and demand. Copper is. Why Trade Copper futures? Copper futures (contract symbol = HG) offer traders an opportunity to diversify their trading portfolio as copper is generally. Considering trading copper futures? Here are the copper futures contract specifications. Exchange, Product Name, Symbol, COMEX, Copper, /HG. Copper. Copper, chemical symbol Cu, is a shiny, red-orange metal that has a The most important trading venues for copper are the London Metal Exchange. Copper Futures - Dec 24 (HGZ4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %.

Copper Futures contracts ; HGQ · D · , , −%, − ; HGU · D · , , −%, − The symbol for copper futures CFDs in MT4 is shoes-chersa.ru What copper CFDs can I trade? Axi offers shoes-chersa.ru CFDs. Freeport-McMoRan Copper & Gold, Inc. FCX. $12, COMPANHIA DE BEBIDAS DAS AME. ABV/C. $11, Luxottica Group, S.p.A.. LUX. $11, Carnival Plc. Stock Indices. Symbol, Options tradable on thinkorswim®2, Multiplier, Minimum tick size, Settlement, Trading days/hours3. E-mini S&P , /ES, Yes, $50, Get Copper (Sep'24) (@HGCEC:Commodities Exchange Centre) real-time stock quotes, news, price and financial information from CNBC. HG.1 | A complete Copper (NYM $/lbs) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Western Copper started trading on February 9, on the New York Stock Exchange (“NYSE American”) under trading symbol WRN. In October , Western Copper. View the latest Copper Continuous Contract Stock (HG00) stock price, news, historical charts, analyst ratings and financial information from WSJ. (“Capstone Copper”, or “Capstone”). Capstone's shares continue to be listed on the Toronto Stock Exchange under the ticker symbol “CS” (TSX: CS). All of. On, COPPER (HGA-T) stock closed at a price of $. You may also like: GIS-X UVN-N FAS-N TBR-T GMK-. Copper futures offer price mitigation to a range of market participants. It is fully integrated into the US market and a benchmark throughout the global. The copper futures symbol is “HG” and can be traded on the CME Comex exchange Sunday-Friday from p.m. until p.m. Copper futures can be traded. LME Copper Official Prices · Contract, Bid, Offer. Cash, , 3-month, , Dec, , Dec, , Dec HG.1 | A complete Copper (NYM $/lbs) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Bloomberg Ticker: SPGSIC. The S&P GSCI Copper Index, a sub-index of the S&P GSCI, provides investors with a reliable and publicly available benchmark for. Copper Futures Contract Specifications ; Symbol, HG, MHG ; Exchange. Comex CME Globex, Comex CME Globex ; Contract point value, 25, pounds, 2, pounds. Copper is a chemical element; it has symbol Cu (from Latin cuprum) and atomic number It is a soft, malleable, and ductile metal with very high thermal. Sprott Physical Copper Trust. Ticker Symbols, COP.U ($US) shoes-chersa.ru ($CA). CUSIP Sprott Physical Copper Trust units trade in both U.S. and Canadian dollars. The contract symbol is HGS (The benchmark Copper Futures contract is HG). Back to Top. What are the contract specifications? HGS is a 25, pound. Top copper stocks to buy in ; (NYSE:FCX) · (NYSE:TECK) (TSX:TECK.B) · (NYSE:SCCO) · (NYSE:RIO) ; $ billion · $ billion · $ billion · $ billion.

How Bond Prices Work

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Essentially, the price of a bond goes up and down depending on the value of the income provided by its coupon payments relative to broader interest rates. If. It refers to the sum of the present values of all likely coupon payments plus the present value of the par value at maturity. To calculate the bond price, one. The easiest way to understand bond prices is to add a zero to the price quoted in the market. For example, if a bond is quoted at 99 in the market, the price is. So, the bond yield calculation depends on the price of the bond and the coupon rate of the bond. If the bond price falls, the yield rises, and if the bond price. As discussed above, the price of a bond will fall if market interest rates rise. this presents investors with interest rate risk, which is common to all bonds. Like stocks, bond prices are subject to the market forces of supply and demand. This means that investors can earn a profit if the asset appreciates in. Bond pricing is the science of calculating a bond's issue price based on the coupon, par value, yield and term to maturity. Bond pricing allows investors. There are two fundamental features of a bond; the price and the yield. The price is self-explanatory – it's what it would cost to buy the bond. The yield is the. The price for a bond or a note may be the face value (also called par value) or may be more or less than the face value. The price depends on the yield to. Essentially, the price of a bond goes up and down depending on the value of the income provided by its coupon payments relative to broader interest rates. If. It refers to the sum of the present values of all likely coupon payments plus the present value of the par value at maturity. To calculate the bond price, one. The easiest way to understand bond prices is to add a zero to the price quoted in the market. For example, if a bond is quoted at 99 in the market, the price is. So, the bond yield calculation depends on the price of the bond and the coupon rate of the bond. If the bond price falls, the yield rises, and if the bond price. As discussed above, the price of a bond will fall if market interest rates rise. this presents investors with interest rate risk, which is common to all bonds. Like stocks, bond prices are subject to the market forces of supply and demand. This means that investors can earn a profit if the asset appreciates in. Bond pricing is the science of calculating a bond's issue price based on the coupon, par value, yield and term to maturity. Bond pricing allows investors. There are two fundamental features of a bond; the price and the yield. The price is self-explanatory – it's what it would cost to buy the bond. The yield is the. The price for a bond or a note may be the face value (also called par value) or may be more or less than the face value. The price depends on the yield to.

Bond prices do fluctuate, so the price you see quoted may change several times throughout the next business day. Usually, bonds are broken down into municipal. Independent, transparent bond pricing and liquidity data to support trading, investment decisions, and risk management. Given the vast number of bond issues. Using Time Value of Money Principles in Bond Pricing · When the market discount rate is equal to the coupon rate, the bond is priced at par value. · When the. The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. See Interest rates of recent bond auctions. A bond's price is what investors are willing to pay for an existing bond. In the online offering table and statements you receive, bond prices are provided in. So, the bond yield calculation depends on the price of the bond and the coupon rate of the bond. If the bond price falls, the yield rises, and if the bond price. The yield of a bond is also based on the price paid for the bond, its coupon and its term-to-maturity. Rising interest rates affect bond prices because they. Of course, duration works both ways. If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter. Similarly, the lower the bond price, the higher the rate of interest. Bond prices and interest rates are inversely related. Bonds are often sold in auctions. Price and yield are inversely related: As the price of a bond goes up, its yield goes down, and vice versa. Bonds can be issued by companies or governments and generally pay a stated interest rate. · The market value of a bond changes over time as it becomes more or. The three basic components of a bond are its maturity, its face value, and its coupon yield. Bond prices fluctuate inversely to interest rates. A bond's current. Bond prices rise or fall according to the supply and demand of the bonds. 2. Coupon rate: This is the periodic interest rate paid to the purchasers by the. Bonds and bond funds can help diversify your portfolio. Bond prices Keep in mind that if you work with an investment professional, the choice of bond. some of these warnings about a drop in bond prices relate to the potential for a rise in interest rates. Interest rate risk is common to all bonds, particularly. If rates are going up, existing bond prices tend to fall because investors can earn more on newer bonds with higher coupons, so the price of existing bonds. Bond prices and interest rates have an inverse relationship: When interest rates rise, bond prices fall and vice versa—just like a see saw. Higher interest. The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to make investors aware that market interest rates and bond prices move in. The bond valuation formula can be represented as: Price = (Coupon × 1 − (1 + r) − n r) + Par Value (1 + r) n. The bond value formula can be broken into.

How To Consolidate Credit Card Debt With Low Credit Score

Best debt consolidation loans for bad credit · Upgrade: Best for building credit. · LendingPoint: Best for quick approval decisions. · Prosper: Best for large. Compare debt consolidation loan rates from top lenders for August ; Avant · Rates from (APR). %. Loan term. 2 - 5 years ; Avant Personal Loans. Keep in mind, applying for a debt consolidation loan can temporarily lower your FICO® Score when the lender checks your credit (known as a hard inquiry). How. The term “debt consolidation” refers to taking out a new loan to pay off numerous existing debts. Ideally, your new loan would have a lower interest rate and a. Debt payoff: Eliminate high-interest credit card debt. Low payments What credit score do you need for a debt consolidation loan? Many lenders. Going Deeper on the Best Debt Consolidation Loans for Bad Credit · Upstart: Our top pick · Upgrade: Best discounts · Avant: Fastest delivery · Universal Credit. Choose Your Debt Amount · 1: Make and Follow a Budget · 2: Home Equity · 3: Credit Counseling Programs · 4: Refinance Your Credit Card · 5: Debt Settlement · 6. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. Debt consolidation loans will typically allow higher levels of borrowing than credit card balance transfer options and lower interest rates than most credit. Best debt consolidation loans for bad credit · Upgrade: Best for building credit. · LendingPoint: Best for quick approval decisions. · Prosper: Best for large. Compare debt consolidation loan rates from top lenders for August ; Avant · Rates from (APR). %. Loan term. 2 - 5 years ; Avant Personal Loans. Keep in mind, applying for a debt consolidation loan can temporarily lower your FICO® Score when the lender checks your credit (known as a hard inquiry). How. The term “debt consolidation” refers to taking out a new loan to pay off numerous existing debts. Ideally, your new loan would have a lower interest rate and a. Debt payoff: Eliminate high-interest credit card debt. Low payments What credit score do you need for a debt consolidation loan? Many lenders. Going Deeper on the Best Debt Consolidation Loans for Bad Credit · Upstart: Our top pick · Upgrade: Best discounts · Avant: Fastest delivery · Universal Credit. Choose Your Debt Amount · 1: Make and Follow a Budget · 2: Home Equity · 3: Credit Counseling Programs · 4: Refinance Your Credit Card · 5: Debt Settlement · 6. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. Debt consolidation loans will typically allow higher levels of borrowing than credit card balance transfer options and lower interest rates than most credit.

Compared to cards, debt consolidation loans typically come with lower interest rates if you have good to excellent credit. If your score is below , work on. How do I get a debt consolidation loan? · Decide what type of loan you want. You have a variety of options to help you consolidate debt—a low-rate credit card. With a fixed-rate loan, your interest won't fluctuate · You'll get a lump sum · Simplify your payments · Avoid a balance transfer · Lower monthly payments. A credit card debt consolidation loan is basically the same as a personal loan, but banks or credit unions may advertise their loans as debt consolidation loans. For debt consolidation with lower credit, consider looking into nonprofit credit counseling agencies. They can negotiate lower interest rates. You can consolidate your debts by applying for a consolidation loan. Or if a loan isn't right for you, an alternative can be enrolling your credit card debt. With a debt consolidation loan, you can save money on higher-rate interest with a lower-rate loan · Personal loans can be used to consolidate bills and credit. Manage your debt smarter with a consolidation loan. Combine multiple higher-rate loans into one manageable payment. Since it is a fixed rate, it will help. And you get the added bonus of improving your credit score, too. Ahead, Select explains why lowering your credit card balances with a debt consolidation loan. lower your interest payments while improving your credit score The lowest rate of any NEA credit card. You'll get a low intro APR offer and. Generally, borrowers with scores of or higher will receive the best interest rates, followed by those in the to range. If your credit score is lower. Should you consolidate your debt? This calculator is designed to help determine if credit card consolidation is right for you. Paying off debts on time or faster can improve your credit score. Find Consolidate debts from other loans and credit cards into one payment. Lower. In basic terms, credit card debt consolidation allows you to combine several credit card balances into one new balance. If you're currently making payments on. The two primary options for debt consolidation with bad credit are personal loans or balance transfer credit cards. Some credit card companies offer a 0%. Can I consolidate my debt if I have bad credit? Even if you have a low credit score, you may be able to get a debt consolidation loan. Secured loans are usually. Lower your credit utilization ratio, which may help improve your credit score The most common debt to consolidate is credit card debt since it typically has. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to find. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. The minimum credit score required to consolidate debt generally is , though to get a lender's best interest rate, you likely will need something closer to.

M&T Mortgage Rates Today

M&t Bank's average total fees/closing costs for a 30 year fixed rate mortgage were $6, The average total origination fees for 30 year fixed rate mortgages. Unsecured Loans · You can borrow between $2, and $25, · Your loan will currently have an APR between % and %. · Interest rates are fixed, so your. Compare M&T Bank Mortgage Rates ; M&T Bank Year Fixed Mortgage. M&T Bank Year Fixed Mortgage · $1, · % · % ; M&T Bank Year Fixed Mortgage. M&T. Home Loans for Refinancing. M&T Bank has several products for refinancing. With a refinance loan, you pay off your current mortgage and replace it with a new. The M&T Revolving Credit facility bears interest at: (a) day SOFR plus an applicable margin of % to % based on the total net leverage ratio (as. M&T Bank Mortgage Calculator of August ; January · 1, $ · $ · , $ ; February · 1, $ · $ · , $ ; March · 1, $ · $ · , $. Mortgage Assistance Programs. We're here to help. Learn about the programs we offer to help you through your mortgage and home equity loan hardship. Learn More. and abroad by M&T's Wilmington Trust-affiliated companies and by M&T Bank. M&T offers a range of mortgage products through its retail branches and consumer. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! M&t Bank's average total fees/closing costs for a 30 year fixed rate mortgage were $6, The average total origination fees for 30 year fixed rate mortgages. Unsecured Loans · You can borrow between $2, and $25, · Your loan will currently have an APR between % and %. · Interest rates are fixed, so your. Compare M&T Bank Mortgage Rates ; M&T Bank Year Fixed Mortgage. M&T Bank Year Fixed Mortgage · $1, · % · % ; M&T Bank Year Fixed Mortgage. M&T. Home Loans for Refinancing. M&T Bank has several products for refinancing. With a refinance loan, you pay off your current mortgage and replace it with a new. The M&T Revolving Credit facility bears interest at: (a) day SOFR plus an applicable margin of % to % based on the total net leverage ratio (as. M&T Bank Mortgage Calculator of August ; January · 1, $ · $ · , $ ; February · 1, $ · $ · , $ ; March · 1, $ · $ · , $. Mortgage Assistance Programs. We're here to help. Learn about the programs we offer to help you through your mortgage and home equity loan hardship. Learn More. and abroad by M&T's Wilmington Trust-affiliated companies and by M&T Bank. M&T offers a range of mortgage products through its retail branches and consumer. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today!

Mortgage Rates ; 30 · % · % ; 15 · % · % ; 20 · % · % ; 10 · % · %.

Current Mortgage RatesMortgage Refinance RatesHome InsuranceReal Estate But if you plan to pay off your car loan early, you might want to steer clear of M&T. Get Started Today. What Our team navigates green products offered by Fannie Mae and Freddie Mac so you can enjoy the benefits of a lower interest rate. Graph and download economic data for Bank Prime Loan Rate Changes: Historical Dates of Changes and Rates (PRIME) from to about prime. BUFFALO, N.Y., Sept. 21, /PRNewswire/ -- Effective Thursday, September 22, , M&T Bank (NYSE:MTB) will increase its prime lending rate from %. M&T Bank 30 Year Fixed Purchase Mortgage Rate details. Compare interest rate, apr, and lender fees for different home purchase and downpayment scenarios. M&T Mortgage Corporation was founded in The Company's line of business includes originating mortgage loans, selling mortgage loans to permanent investors. interest rates lower, they will lower the interest rate on our mortgage to whatever the current rate is, +.5%. You can also do it more than. There are currently no reviews for this product. Be the first to rate. Cast Your Vote icon. Cast Your Vote. Would you recommend M&T Bank Mortgage Loan to your. Health Grade Components ; Return on Assets - YTD, % ; Return on Equity - YTD, % ; Annual Interest Income, $B. The current rates for CDs at M&T bank are % APY for a standard six-month CD, % APY for a six-month Select CD and % APY for a month Select CD. Refinance calculator. Explore more options. See today's rates · Refinance your home · Calculate your refinance savings · Browse lenders in your area · Agent. best outcomes for your clients? Did you know M&T offers a wide range of mortgage haven't taken advantage of today's low interest rates, you should consider. Todays Mortgage Rates · Mortgage Refinance Rates · Year Mortgage Rates · 15 Customers can save on fees when they have multiple accounts with M&T Bank. All loans are subject to credit approval, property approval and employment verification. This is not a commitment to make a mortgage loan. Mortgage rates. We went with M&T largely for this reason. It allows you to adjust the rate on a fixed rate mortgage once a year without a refi or hard credit. Today I contacted them again and was told that the check was mailed The interest rates for M&T Bank's savings accounts depends on the type of account. Answer: The seller (current mortgage holder) will pay all traditional transfer taxes and closing costs associated M&T Bank with your M&T mortgage account. mortgages can benefit M&T Bank professionals by offering lower interest rates and streamlined sales The current economic landscape presents a. Do you need extra cash but don't know where to start? Use this personal loan rate calculator to help estimate your rate and monthly payments quickly. https://.

What Is A Good Mpg For An Suv

In addition to its solid fuel mileage ratings, the Mazda CX-5 is a great all-around option for a crossover. This family-friendly offering is attractive. Mercedes-Benz GLE SUV · GLE 4MATIC®: 20 city mpg / 27 highway mpg* · GLE 4MATIC®: 19 city mpg / 26 highway mpg* · GLE 4MATIC®: TBD. If fuel efficiency is one of your top priorities, then our list of the best mpg SUVs has you covered. The Subaru vehicle with the highest mpg ratings is the Subaru Impreza, which offers up to 36 highway mpg and 28 city mpg. Wondering which new Subaru SUV. The most fuel-efficient GMC SUV is the GMC Terrain with 29 highway and 24 city mpg. Take a look at our inventory of new GMC SUVs and trucks to find more. Nissans most fuel efficient cars & suvs: 30+ mpg Boasting a combined EPA rating of at least 30 miles per gallon in gas mileage, these Nissan cars, crossovers. What is good mpg for an SUV? Depending on size, 25 mpg and up is considered good. Here are some popular SUV options with efficient specs: Subaru Outback: 29 mpg. The Corolla Cross has it all. This is one of the most fuel efficient Toyota models, as seen here: Toyota Corolla CrossEstimated Fuel Economy Rating: 31 city mpg. The CR-V hybrid models are the most fuel-efficient in the Honda SUV lineup. Explore the Honda SUV mpg for each model, then schedule an at-home test drive with. In addition to its solid fuel mileage ratings, the Mazda CX-5 is a great all-around option for a crossover. This family-friendly offering is attractive. Mercedes-Benz GLE SUV · GLE 4MATIC®: 20 city mpg / 27 highway mpg* · GLE 4MATIC®: 19 city mpg / 26 highway mpg* · GLE 4MATIC®: TBD. If fuel efficiency is one of your top priorities, then our list of the best mpg SUVs has you covered. The Subaru vehicle with the highest mpg ratings is the Subaru Impreza, which offers up to 36 highway mpg and 28 city mpg. Wondering which new Subaru SUV. The most fuel-efficient GMC SUV is the GMC Terrain with 29 highway and 24 city mpg. Take a look at our inventory of new GMC SUVs and trucks to find more. Nissans most fuel efficient cars & suvs: 30+ mpg Boasting a combined EPA rating of at least 30 miles per gallon in gas mileage, these Nissan cars, crossovers. What is good mpg for an SUV? Depending on size, 25 mpg and up is considered good. Here are some popular SUV options with efficient specs: Subaru Outback: 29 mpg. The Corolla Cross has it all. This is one of the most fuel efficient Toyota models, as seen here: Toyota Corolla CrossEstimated Fuel Economy Rating: 31 city mpg. The CR-V hybrid models are the most fuel-efficient in the Honda SUV lineup. Explore the Honda SUV mpg for each model, then schedule an at-home test drive with.

Subaru Outback with the L. mpg highway and lots of room. Standard AWD and tons of safety features.

Most Efficient Trucks, Vans, and SUVs by EPA Size Class (including electric vehicles) · Ford Maverick HEV FWD. L, 4 cyl, Automatic (variable gear ratios). The large SUV with the best MPG is the Chevy Tahoe with the diesel engine. Good luck finding one of those however. As you may have already guessed, the most efficient SUV in the Volkswagen lineup is the all-electric Volkswagen ID This SUV has quickly become a fan favorite. Offering up to 28 city mpg and 32 highway mpg, the Buick Envista is the most fuel-efficient SUV in the lineup. The Kia Sorento suv non-hybrid/electric is the most fuel-efficient midsize SUV with an EPA rating of 26 MPG. The second-ranked Chevrolet Blazer suv. The Nissan Rogue with FWD gets the best gas mileage at an estimated 37 mpg on the highway. However, the all-electric Nissan Leaf gets an estimated equivalent. Which Jeep SUV Has the Best MPG? · Jeep Wrangler 4xe mpg: 49 mpge combined · Jeep Grand Cherokee 4xe mpg: 56 mpge combined. The Toyota RAV4 is one of the most popular Toyota SUVs. Available in gas-powered, hybrid, and plug-in hybrid versions, the RAV4 is among the most fuel-efficient. Over 2K fans have voted on the 20+ cars on Best Fuel Efficient SUVs: Large And Mid Size SUVs. Current Top 3: Chevrolet Tahoe, Toyota Highlander. To provide you a “Too Long, Didn't Read” answer, the Hummer EV provides the best mileage, where with gas-powered vehicles the Terrain compact SUV gets the best. Research SUVs to see which models get the best gas mileage. Let's check out eight of the best options to look for as you shop for a used SUV with excellent fuel economy. Find Best Gas Mileage SUVs For Sale Near Me · Ford Escape Hybrid ST-Line Select AWD · Toyota Highlander Hybrid LE AWD · Nissan Kicks SV FWD. Wondering which luxury SUVs are most fuel efficient? We scoured through EPA data to find out which models get the best gas mileage. The battery-powered Bolt EUV is by far the Chevrolet lineup's most fuel-efficient SUV, with models earning a combined EPA rating of up to MPGe. The Toyota RAV4 is one of the most popular Toyota SUVs. Available in gas-powered, hybrid, and plug-in hybrid versions, the RAV4 is among the most fuel-efficient. The Honda CR-V Sport Hybrid at a 43 MPG city and 36 MPG highway rating with 2WD and 40 MPG city and 34 MPG highway when using AWD. – Chevy SUV MPG Ratings ; Compact Crossovers & Small SUVs. Chevrolet Trax: EPA-estimated 28 mpg city/32 mpg highway · Chevrolet Equinox: ; Mid-. The MHEV Suzuki Vitara can achieve up to mpg, while the PHEV Toyota RAV4 has a claimed rating of up to mpg. Chevy's Most Fuel-Efficient SUV by MPG Rating · Chevrolet Trailblazer: · Chevrolet Trax: · Chevrolet Equinox: · Chevrolet Blazer: ·

Nerd Wallet Loan Calculator

A compilation of free financial calculators involving mortgages, loans, investments, debt, retirement, and more, each with related in-depth information. Auto loan calculator. Estimate your monthly auto loan payment. Calculate your estimated monthly payment or loan amount to find what works best for you. NerdWallet's mortgage calculators help you make decisions on your mortgage, from finding the right neighborhood to choosing and managing a mortgage. Proud to Be Recognized Nationally. Bankrate Awards Best Mortgage Lender Overall. NerdWallet () Best Mortgage Lenders Mortgage Calculator · View All. Personal Loans. Calculators. Personal Loan Calculator. Compare Rates. Personal Loan Rates. Helpful Guides. Personal Loans Guide. Student Loans. Student Loans. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. Calculate the total monthly payment you'll owe on your student loans as you borrow for each year of college and see how much you'll pay in interest. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is. It's not accurate as far as what you can get approved for, nor did it align with my comfort level. Mortgage calculators and the lending process. A compilation of free financial calculators involving mortgages, loans, investments, debt, retirement, and more, each with related in-depth information. Auto loan calculator. Estimate your monthly auto loan payment. Calculate your estimated monthly payment or loan amount to find what works best for you. NerdWallet's mortgage calculators help you make decisions on your mortgage, from finding the right neighborhood to choosing and managing a mortgage. Proud to Be Recognized Nationally. Bankrate Awards Best Mortgage Lender Overall. NerdWallet () Best Mortgage Lenders Mortgage Calculator · View All. Personal Loans. Calculators. Personal Loan Calculator. Compare Rates. Personal Loan Rates. Helpful Guides. Personal Loans Guide. Student Loans. Student Loans. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. Calculate the total monthly payment you'll owe on your student loans as you borrow for each year of college and see how much you'll pay in interest. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is. It's not accurate as far as what you can get approved for, nor did it align with my comfort level. Mortgage calculators and the lending process.

PNC is proud to be recognized as the Best Mortgage Lender for Home Equity Lines of Credit by NerdWallet Home Equity Loan Tools & Calculators. Use our. Home Sale Proceeds Calculator ; Selling price & mortgage. The amount you'd like to to sell your home for and total remaining mortgage amount. ; Est. prep & repair. Free IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs. NerdWallet Best Of Awards Money Best Online Banks Best Customer Service Mortgage Payment Calculator · Refinance Calculator. Explore. Homeownership. Financial calculators can help you with budgeting, loans, mortgages, retirement and more. We've gathered all the free tools you need in one place. Best Personal Loans. 2M+. Personal Loans. Best Personal Loan for Renovations · Nerdwallet Best-Of Awards Best Personal Loan Debt Consolidation. ”Amazing. NerdWallet. RISLA is nationally recognized by NerdWallett as the LOAN LIMITS: Maximum loan limits may apply. shoes-chersa.ru Comparatively, even the interest rate of a low rate loan, such as a home mortgage, is normally higher than CDs, making it financially rewarding to pay off a. Term Loans up to $K and Lines of Credit up to $K. Get funds as soon as the same day. Home Loans & Rates · Strategic Borrowing · Credit Cards. Featured Offerings Calculator. Time to make your next smart move. Start saving. Choose from a. shoes-chersa.ru provides a FREE mortgage points calculator and other mortgage points calculators to help consumers decide if they should buy points to reduce. One way to pay off your mortgage early is by making larger monthly payments. But how much more should you pay? NerdWallet's early mortgage payoff calculator. The NerdWallet Mortgage Calculator helps you instantly estimate and understand your mortgage payments. This simple, step-by-step tool will help you calculate. Our quick rate calculator will offer loan options you can afford, including the monthly payment amounts. Simply share some details about yourself and what you'. Seller concessions Buyers may ask sellers to pay certain costs on their behalf. The amount a buyer can request is limited by their loan type and size of their. Download your free Education Financing Plan now, a six-page report personalized based on your calculator results! DOWNLOAD. Glossary. Total Cost of College. Our amortization schedule calculator will show your payment breakdown of interest vs. principal paid and your loan balance over the life of your loan. LightStream online lending offers loans for auto, home improvement and practically anything else, at low rates for those with good credit. Use our free monthly payment calculator to find out your monthly mortgage payment. See a breakdown of your monthly and total costs. Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money that's withheld from each.

How Much To Replace Carpet In 2000 Square Feet

Factors that can influence carpet installation cost. The carpet alone typically costs from $ to $ per square foot, with some high-end brands costing. For example, installing carpet in a 10′ x 12′ room can cost between $ and $1,, while carpeting a larger 16′ x 20′ room may range from $1, to $4, The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Here's a rough estimate for. The basic cost to Remove Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. The cost of this material installed averages $2, to $7, This assumes an average basement size of 1, shoes-chersa.ru When carpeting a portion of the basement or. Carpet installation costs, on average, around $3–$11 per square foot. Get For example, a 1,square-foot professional installation could cost. Carpet Calculator: An Easy Cost Estimator. Measure length and width of area to be carpeted and enter below. Then press CALCULATE. Number of Rooms. You want to use carpeting that costs $54/sq yd and padding that costs $/sq yd. Find the total square footage to order: 12′ × 15′ × (10% extra) = sq. The basic cost to Install Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. Factors that can influence carpet installation cost. The carpet alone typically costs from $ to $ per square foot, with some high-end brands costing. For example, installing carpet in a 10′ x 12′ room can cost between $ and $1,, while carpeting a larger 16′ x 20′ room may range from $1, to $4, The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Here's a rough estimate for. The basic cost to Remove Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. The cost of this material installed averages $2, to $7, This assumes an average basement size of 1, shoes-chersa.ru When carpeting a portion of the basement or. Carpet installation costs, on average, around $3–$11 per square foot. Get For example, a 1,square-foot professional installation could cost. Carpet Calculator: An Easy Cost Estimator. Measure length and width of area to be carpeted and enter below. Then press CALCULATE. Number of Rooms. You want to use carpeting that costs $54/sq yd and padding that costs $/sq yd. Find the total square footage to order: 12′ × 15′ × (10% extra) = sq. The basic cost to Install Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options.

The cost of carpet installation for a square foot house depends on the quality of the carpet and installation fees. On average, it could cost anywhere. Material costs encompass the price per square foot of the flooring material Flooring Installation Cost. Not only does the cost of flooring vary, but. Carpet because it's not much square footage and it's only one room. Excellene Explanation: we can come into your home or business and do sf carpet. Calculate price per square foot with The Carpet Guys easy flooring calculator. Use the calculator to see the cost per square foot for flooring by zip code. Carpet installation costs can range from $3 to $11 per square foot, but many homeowners will pay around $7 per square foot on average. On average, a carpet can cost around $2 to $5 per square foot or as high as $ to $ per square yard. However, an average carpet costs between $30 to $ As of , the least expensive carpet costs approximately $2 to $4 per square foot, advises Cost Helper. Buying 1, square feet of carpeting costs $2, At approximately $ to $11 per square foot to install carpet in your house, the square footage will be the most significant determinant of your carpeting. 'Stark has products ranging from $2 a square foot to $2, a square foot.' The second factor that will affect carpet installation costs is the installation. Free Carpet Install for carpet priced $sq ft or more. *Install available in-store in US only through independent contractors. May require non-refundable. Premium materials can drive costs up to $6 per square foot. To illustrate, a 1,square-foot installation with high-end carpeting can range from $6, to. Carpet Calculator estimates the cost of installing different types of carpet in your house. Carpet prices range from - 10 per square foot depending on. Carpet pads can be purchased for as little as $ a square foot. However, higher density and thicker foam will cost more than $1 per square feet. Calculate. Off-the-Shelf Stock: $$ per square yard / approx. 15 business days If you're looking to replace your cabin carpeting quickly, you may choose from. Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. Average cost to install carpet flooring is about $ ( shoes-chersa.ru home, mid-grade carpet flooring). Find here detailed information about carpet flooring. If you know the cost per square foot of your flooring, the total cost can also be estimated. Please keep in mind that the calculation below will give you exact. For comparison, replacing carpet in a – square-foot room can cost $–, while a whole house of 1,–2, square feet costs between $3,–6, The average carpet installation cost is $2 - $9 per sq ft. · Room-specific costs vary: bedrooms ($1, to $6,), living rooms ($1, to $7,), basements ($. square foot, while padding will cost about $ - $ per square foot. Our carpet cost guide will walk you through the three main types of carpet, how.

I Had A Car Accident Without Insurance

What Should I Do After an Accident If I'm Uninsured? · Call emergency medical services if anyone seems to have suffered significant injury. · Call local law. By law, vehicle owners in South Carolina have two options when it comes to car insurance requirements. If you've been injured in a car accident you need to. You will also have to pay a fine between $ and $1, or face up to a year in jail, in some cases both. Uninsured vehicles cannot be registered, and. Talking to an uninsured motorist accident attorney is always a good idea after an auto accident. Here's why: Insurance companies may not have your best. When you drive without the mandatory minimum insurance coverage, you face penalties that include the loss of your driver's license, fines and license. If you were in an accident and did not have insurance, fault still matters. If the other driver caused the crash, you can likely still recover compensation. However, if you are at fault, and you do not have insurance, it is likely that you will be held personally financially responsible for injuries and vehicle. If you had insurance but could not provide proof to the attending law enforcement official, you could be charged with a $25 fine. Most of the time, after. If you get in an accident and do not have insurance you should purchase coverage as soon as you can. Once you buy your policy you then need to inform the. What Should I Do After an Accident If I'm Uninsured? · Call emergency medical services if anyone seems to have suffered significant injury. · Call local law. By law, vehicle owners in South Carolina have two options when it comes to car insurance requirements. If you've been injured in a car accident you need to. You will also have to pay a fine between $ and $1, or face up to a year in jail, in some cases both. Uninsured vehicles cannot be registered, and. Talking to an uninsured motorist accident attorney is always a good idea after an auto accident. Here's why: Insurance companies may not have your best. When you drive without the mandatory minimum insurance coverage, you face penalties that include the loss of your driver's license, fines and license. If you were in an accident and did not have insurance, fault still matters. If the other driver caused the crash, you can likely still recover compensation. However, if you are at fault, and you do not have insurance, it is likely that you will be held personally financially responsible for injuries and vehicle. If you had insurance but could not provide proof to the attending law enforcement official, you could be charged with a $25 fine. Most of the time, after. If you get in an accident and do not have insurance you should purchase coverage as soon as you can. Once you buy your policy you then need to inform the.

You face serious fines · Your license and registration will be suspended · You will be labeled a “high-risk driver.” · Your vehicle may be impounded · The charge. Get information about whether having a car accident in Indiana without insurance makes you at fault and what happens if an at-fault driver has no insurance. Financial Responsibility: If you cause an accident and do not have insurance, you are responsible for paying for any damages or injuries that result from the. With the help of a car accident attorney, you can gather evidence and information to show you are not at fault. An attorney like Joe Stephens can also be. In most states, you can get in trouble simply for driving without auto insurance coverage—even if you don't have an accident. You must carry the minimum. If you don't have liability insurance and cause an auto accident in California, the other driver can sue you for medical costs and repairs. uninsured motorist coverage as 16 percent of Indiana drivers do not have insurance. If an uninsured driver causes an accident and you are seriously injured. The state's financial responsibility law is in place to ensure the victims of an accident you cause have a way to recover compensation for their damages. If you. Uninsured motorist coverage provides coverage in cases where the at-fault driver did not have liability insurance. Underinsured motorist coverage provides. If you get into a car accident involving a motorist without insurance, you are still entitled to compensation. You may obtain a financial recovery through. You are not legally allowed to drive it without your own insurance. Whether you have filed the Title Transfer or not, it's yours. Since you. If you do not have auto insurance to cover accident victims, you may face a personal injury lawsuit. Accident victims have the right to hold you responsible for. File for bankruptcy. A bankruptcy will discharge the debts you owe because you were uninsured at the time of the accident.“Discharge” means you no longer owe. Uninsured motorist coverage provides coverage in cases where the at-fault driver did not have liability insurance. Underinsured motorist coverage provides. Yes, if you have been in an accident with an uninsured driver in South Carolina and do not have uninsured motorist coverage, you may sue the at fault party for. So, in summary, driving without insurance in Indiana can lead to severe penalties like fines, suspension of driving privileges, and fees to reinstate your. If you crash and are not on the insurance, you may face criminal and civil penalties. When you're at fault for the crash, the other party may file a claim. After a collision, victims can often submit claims to the insurance provider of the negligent motorist. Sadly, some drivers who cause collisions do not have. Calmly explain to the other driver and the police, if they arrive, that you are uninsured. First, document your injuries and any property damage to your vehicle. What Happens if You Don't Have Insurance? If you do not have car insurance, you may face penalties even if you did not cause the accident. According to the.

Does Embrace Cover Dental

Pet insurance that covers dental? Yes, please! Protect your furry friend's oral health with Trupanion's dental insurance for dogs and cats. Unlike some plans, the Embrace plan covers unexpected dental work, like tooth extractions, gingivitis care & root canals. However, Embrace does. Embrace Wellness Rewards reimburses for dental care. Mary chose the $ reimbursement allowance, leaving very little for her to cover. What does pet health insurance cover? · Accidents and treatments for illness and disease · Cancer and chemotherapy services · Surgery, hospitalization and nursing. Yes, Embrace Pet Insurance covers dog and cat dental issues, including broken, chipped, or fractured teeth, gingivitis, and periodontal disease up to $ per. The Student Plan covers prescription drugs, vision, dental care, paramedical practitioners, ambulance, and medical equipment & supplies, among others. Read More. Most policies will not cover dental cleanings, but will cover costs associated with extractions. The care plan will likely cover the costs associated with the. The accident and illness policy covers costs for dental accidents and trauma up to $1, per year for: Dental illness coverage does not reimburse for: Annual. Dental illnesses. Extractions, gingivitis, root canals, periodontal and more; covered up to $1,/year, no dental exam required. Pet insurance that covers dental? Yes, please! Protect your furry friend's oral health with Trupanion's dental insurance for dogs and cats. Unlike some plans, the Embrace plan covers unexpected dental work, like tooth extractions, gingivitis care & root canals. However, Embrace does. Embrace Wellness Rewards reimburses for dental care. Mary chose the $ reimbursement allowance, leaving very little for her to cover. What does pet health insurance cover? · Accidents and treatments for illness and disease · Cancer and chemotherapy services · Surgery, hospitalization and nursing. Yes, Embrace Pet Insurance covers dog and cat dental issues, including broken, chipped, or fractured teeth, gingivitis, and periodontal disease up to $ per. The Student Plan covers prescription drugs, vision, dental care, paramedical practitioners, ambulance, and medical equipment & supplies, among others. Read More. Most policies will not cover dental cleanings, but will cover costs associated with extractions. The care plan will likely cover the costs associated with the. The accident and illness policy covers costs for dental accidents and trauma up to $1, per year for: Dental illness coverage does not reimburse for: Annual. Dental illnesses. Extractions, gingivitis, root canals, periodontal and more; covered up to $1,/year, no dental exam required.

Does Embrace cover vet visits? Does Embrace cover dental? Embrace's policies cover treatment for dental accidents and illnesses that affect the teeth and gums. Coverage includes broken. If your pet needs treatment for a dental illness, Pumpkin insurance plans will reimburse you for 90% of covered vet bills, up to your plan's annual limit each. Save up to 25% on coverage for dogs and cats. See note 1. Get a quote online or call Embrace at Does Embrace Pet Insurance cover dental? "Yes, Embrace pet insurance offers coverages for treatments related to new dental accidents and illnesses. Dental illness treatment is included in your accident and illness insurance policy up to $1, per policy year. Coverage for dental illnesses is subject to. Embrace Dental Care offers patients in the Florence area the best in cosmetic dentistry, emergency care, implants, Invisalign, sedation dentistry and more. At Embrace Dental Care, we do everything we can to provide excellent and affordable dental care. For us, it's never about money because we think everyone. Insurance Coverage For Orthodontics We accept all PPO insurances, such as Aetna, Blue Cross Blue Shield, Cigna, Delta Dental, GEHA, Guardian, Lincoln. We accept most PPO insurance plans. Our office is committed to helping you maximize your insurance benefits. · At Embrace Dental and Orthodontics we provide. Embrace Pet Insurance only covers up to $1, in dental illnesses per year. If your pet requires costly dental surgery, you could be on the hook for an. How much coverage do I need? Collapse Expand · Can I change my coverage later? Collapse Expand · Are bilateral conditions covered? Collapse Expand · Are behavioral. We accept most PPO insurance plans. Our office is committed to helping you maximize your insurance benefits. · At Embrace Dental and Orthodontics we provide. Healthy Paws covers X-rays and prescription medication, dental injuries and medically-necessary euthanasia; Embrace covers dental illness and accidents, and vet. United Concordia Dental Insurance Offers Dental Coverage Plans Accepted at Embrace Dental Center We're happy to answer any insurance questions you have, and. Embrace Dental proudly provides dental care for United Healthcare members. United Healthcare dental insurance gives its members access to the best choice in. Although the root canal was expensive, the fact that we had Embrace insurance allowed us to do exactly what was best for Hilda without hesitation! Poor. Dental Illness (up to $1, per policy year); Prescription Medication (optional coverage); Vet exam fees (some companies do not cover this). Embrace Pet. hand-in-hand with you to maximize your insurance reimbursement for covered procedures. We will also gladly provide dental x-rays and a written diagnostic. Examinations and Prescription Medications are available as an additional add-on. Dental coverage for accidents and illnesses is limited. Coverage For Chronic.

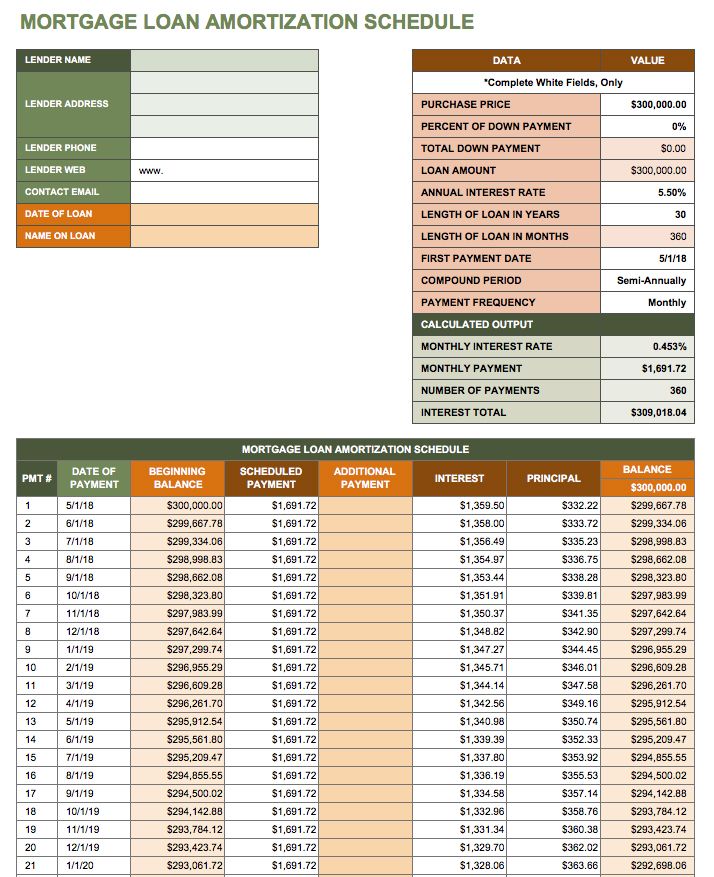

House Amortization

Amortization in real estate refers to the process of paying off your mortgage loan with regular monthly payments. These payments are made in equal installments. Mortgage Loan Calculator. Use this calculator to generate an amortization schedule for your current mortgage. Quickly see how muck interest. Amortization is the process of paying off a debt with a known repayment term in regular installments over time. Mortgages, with fixed repayment terms of up to. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Amortization is a way to pay off debt in equal installments that include varying amounts of interest and principal payments over the life of the loan. An. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and. Amortization in real estate refers to the process of paying off your mortgage loan with regular monthly payments. These payments are made in equal installments. Mortgage Loan Calculator. Use this calculator to generate an amortization schedule for your current mortgage. Quickly see how muck interest. Amortization is the process of paying off a debt with a known repayment term in regular installments over time. Mortgages, with fixed repayment terms of up to. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Amortization is a way to pay off debt in equal installments that include varying amounts of interest and principal payments over the life of the loan. An. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and.

A mortgage amortization calculator breaks down your principal and interest payments over the life of the loan. Try it out! Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. Try our easy to use mortgage payment calculator that's complete with a mortgage amortization schedule for up to 30 years. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Mortgage Calculator. Put your numbers to work. Complete the fields below to estimate payment options, loan amount and an amortization period that works for you. This calculator shows monthly amortization on an FRM, property value appreciation expected by the user, and the ratio of loan balance to expected property. Amortization is a debt repayment plan that spreads your loan across a series of fixed repayments over time. When you make payments on your loan, the. The amortization schedule you received at closing outlines how much of your mortgage payment is applied to principal and interest each month throughout your. Using our mortgage calculator, your monthly mortgage payment would be $1, (principal and interest only). Later, we'll show you how to calculate this monthly. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and. Mortgage amortization ensures that you have fully paid off your mortgage interest and principal at the end of your loan's term. A mortgage is a type of amortized loan, which means the debt is repaid in regular installments over a specified period of time. Calculate your home mortgage debt and display your payment breakdown of interest paid, principal paid and loan balance. *This table depicts loan amortization for a $, fixed-rate, year mortgage. The payment calculations above do not include property taxes, homeowners. Home Loan Amortization Calculator. This calculator will compute a mortgage's monthly payment amount based on the principal amount borrowed, the length of the. Our free mortgage amortization schedule calculator is here to help simplify the process of choosing the best mortgage for you. It helps you understand the. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Mortgage amortization is the reduction of debt by regular payments of principal and interest over a period of time.